All Categories

Featured

Table of Contents

Typically, these financial investments might be riskier, but they use the opportunity for potentially greater returns. Historically, the SEC distinction was to assign people that are taken into consideration to be extra sophisticated financiers.

Exclusive companies can offer protections for investment that are not readily available to the general public. These safety and securities items can consist of: Financial backing Finances (VC)Angel InvestingHedge FundsPrivate Equity OpportunitiesEquity Crowdfunding There are additionally added exclusive financial investment securities that can be accessed by certified capitalists. The interpretation and needs of this sort of financier accreditation have continued to be top of mind considering that its beginning in the 1930s.

Sebi Accredited Investor

These demands are meant to make certain that financiers are educated sufficient to understand the dangers of these investment possibilities. They additionally function to guarantee that prospective financiers have sufficient riches to shield versus financial loss from riskier investments. Today, the criteria for accredited capitalists proceed to be a hot subject.

Others believe that accredited condition ought to be based on their spending acumen (accredited investor income test). Or instead, a combination of such expertise and riches as opposed to being simply wide range or income-based. Despite the fact that these criteria have actually just recently altered, there are some who long for the needs to minimize also further. This will certainly remain to be a fiercely debated subject among the financial crowd.

Non-accredited capitalists were very first able to purchase the Fund in August 2020. Furthermore, financiers might also consider purchasing Yieldstreet items with a Yieldstreet IRA. Recognized capitalists might join all our investment products with their Yieldstreet IRA. Nevertheless, non-accredited capitalists may only purchase the Yieldstreet Choice Revenue Fund with a Yieldstreet IRA.

As for exactly how much this will affect the market relocating ahead, it's likely as well early to tell. When more and more qualified investors seek accreditation, it will certainly be simpler to determine exactly how this brand-new ruling has increased the market, if at all.

Sec Accreditation Requirements

Capitalists should carefully think about the investment purposes, risks, charges and expenses of the YieldStreet Option Revenue Fund prior to spending. The program for the YieldStreet Option Income Fund includes this and various other info about the Fund and can be acquired by describing . The program must be read meticulously before spending in the Fund.

The securities defined in the prospectus are not provided for sale in the states of Nebraska, Texas or North Dakota or to individuals resident or situated in such states (becoming a private investor). No subscription for the sale of Fund shares will be accepted from anyone homeowner or located in Nebraska or North Dakota

(SEC).

The demands of who can and who can not be a certified investorand can take component in these opportunitiesare determined by the SEC. There is an usual misunderstanding that a "process" exists for a specific to come to be a certified financier.

Registered Investor

The problem of confirming a person is a certified financier drops on the financial investment car instead than the investor. Pros of being an approved capitalist consist of access to distinct and limited financial investments, high returns, and boosted diversity. Disadvantages of being an approved capitalist include high danger, high minimal investment amounts, high fees, and illiquidity of the financial investments.

Regulation 501 of Policy D of the Stocks Act of 1933 (Reg. D) offers the definition for a recognized financier. Basically, the SEC defines a recognized capitalist via the boundaries of revenue and total assets in two ways: An all-natural individual with revenue going beyond $200,000 in each of both most current years or joint revenue with a spouse surpassing $300,000 for those years and an affordable expectation of the same income level in the existing year.

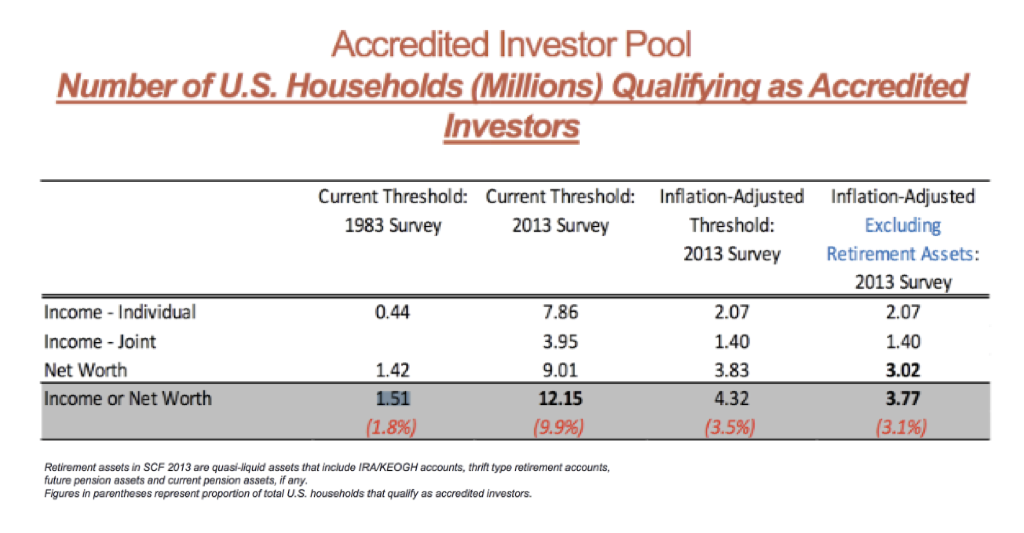

Approximately 14.8% of American Houses qualified as Accredited Investors, and those homes regulated roughly $109.5 trillion in riches in 2023 (private equity investments for accredited investors). Measured by the SCF, that was around 78.7% of all personal wealth in America. Policy 501 also has stipulations for corporations, partnerships, philanthropic organizations, and rely on enhancement to firm directors, equity owners, and financial institutions

The SEC can add accreditations and classifications going ahead to be included in addition to motivating the general public to submit proposals for various other certifications, classifications, or qualifications to be taken into consideration. Employees who are taken into consideration "well-informed workers" of an exclusive fund are currently also thought about to be approved capitalists in relation to that fund.

People who base their certifications on yearly income will likely require to submit income tax return, W-2 kinds, and other records that suggest earnings. People might likewise take into consideration letters from reviews by Certified public accountants, tax lawyers, financial investment brokers, or consultants. Certified capitalist designations also exist in other countries and have comparable needs.

Angel Investor Non Accredited

In the EU and Norway, as an example, there are 3 tests to establish if an individual is a recognized financier. The first is a qualitative test, an analysis of the person's experience, expertise, and experience to figure out that they are capable of making their own investment decisions. The second is a measurable test where the person has to fulfill two of the adhering to standards: Has performed transactions of substantial size on the appropriate market at an average regularity of 10 per quarter over the previous four quartersHas a monetary profile surpassing EUR 500,000 Functions or has functioned in the monetary market for at the very least one year Finally, the client has to state in written kind that they intend to be treated as a professional customer and the company they want to associate with has to give notification of the protections they might lose.

Pros Accessibility to more financial investment possibilities High returns Increased diversity Disadvantages High-Risk financial investments High minimal investment amounts High efficiency charges Lengthy funding lock up time The main benefit of being a certified investor is that it provides you a financial advantage over others. Because your total assets or wage is currently among the highest possible, being a certified financier enables you access to investments that others with much less wealth do not have access to.

How To Become A Investor

One of the most basic examples of the benefit of being a recognized investor is being able to spend in hedge funds. Hedge funds are largely only obtainable to recognized investors due to the fact that they require high minimum financial investment quantities and can have higher connected risks yet their returns can be exceptional.

There are likewise disadvantages to being an approved financier that associate to the investments themselves. A lot of investments that need a specific to be a recognized capitalist featured high danger. The approaches used by several funds come with a higher threat in order to accomplish the goal of beating the marketplace.

Non Accredited Investor Meaning

Simply transferring a few hundred or a few thousand dollars into a financial investment will refrain from doing. Certified financiers will need to commit to a couple of hundred thousand or a couple of million bucks to take part in investments meant for recognized capitalists (how to become an investor). If your financial investment goes south, this is a great deal of money to shed

These mainly been available in the type of efficiency costs along with monitoring costs. Performance fees can vary between 15% to 20%. One more con to being a certified investor is the capacity to access your financial investment funding. If you purchase a few supplies online through an electronic system, you can pull that money out any kind of time you like.

:max_bytes(150000):strip_icc()/accreditedinvestor_final-f821797e377f4f5aaf1310f1f47d181d.jpg)

A financial investment lorry, such as a fund, would have to identify that you qualify as an accredited capitalist. To do this, they would ask you to fill in a questionnaire and possibly provide particular documents, such as financial declarations, credit rating records, or income tax return. The advantages of being an accredited investor consist of access to special financial investment possibilities not readily available to non-accredited financiers, high returns, and boosted diversification in your portfolio.

In certain regions, non-accredited capitalists also have the right to rescission. What this suggests is that if an investor determines they intend to draw out their cash early, they can claim they were a non-accredited financier the entire time and receive their money back. Nevertheless, it's never ever a good idea to provide falsified records, such as phony tax obligation returns or economic declarations to an investment lorry just to invest, and this could bring lawful difficulty for you down the line.

That being said, each deal or each fund may have its own restrictions and caps on investment quantities that they will approve from a capitalist. Approved capitalists are those that meet certain needs concerning revenue, qualifications, or internet well worth.

Latest Posts

Tax Sale Property Listing

Real Estate Tax Sale Law

Property Sold For Delinquent Taxes