All Categories

Featured

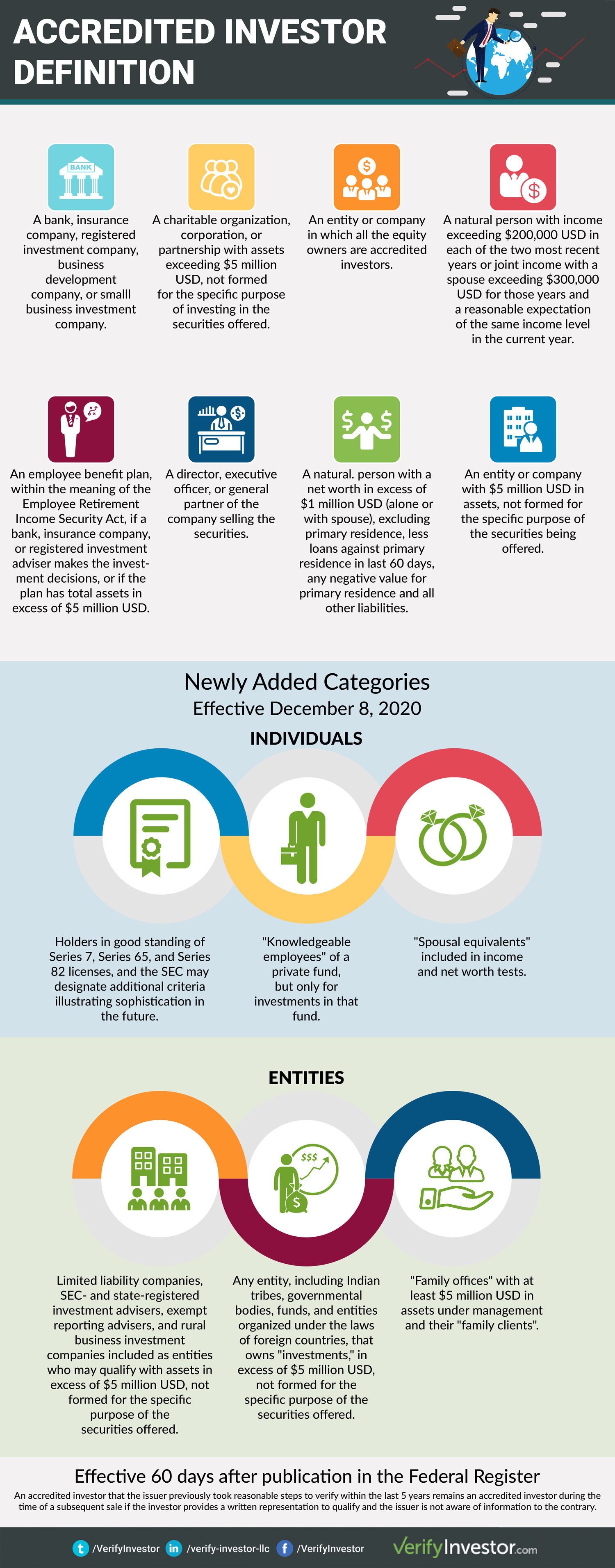

A financial investment car, such as a fund, would certainly need to figure out that you certify as a certified capitalist - accredited investor website. To do this, they would certainly ask you to submit a survey and possibly provide particular records, such as economic declarations, credit rating reports. investor certificate, or income tax return. The benefits of being an approved financier include access to unique financial investment chances not readily available to non-accredited financiers, high returns, and enhanced diversification in your profile.

In certain areas, non-accredited investors additionally have the right to rescission (criteria investors). What this means is that if a capitalist chooses they want to take out their money early, they can claim they were a non-accredited capitalist during and receive their cash back. Nevertheless, it's never a great idea to provide falsified papers, such as fake tax returns or economic statements to a financial investment vehicle just to spend, and this could bring lawful difficulty for you down the line - qualified investor questionnaire.

That being claimed, each offer or each fund may have its own restrictions and caps on financial investment amounts that they will certainly approve from a financier (investing for non accredited investors). Recognized financiers are those that satisfy specific requirements regarding revenue, credentials, or net well worth. They are commonly wealthy individuals (investor qualification questionnaire). Approved capitalists have the possibility to spend in non-registered investments provided by business like exclusive equity funds, hedge funds, angel investments (accredited investor bc), venture capital firms, and others.

Latest Posts

Tax Sale Property Listing

Real Estate Tax Sale Law

Property Sold For Delinquent Taxes